5 Things You Didn’t Know Your Insurance Covered, Including Meteors and John Mclane

Do you really need meteor insurance, or does your homeowners policy already cover you? Assuming you’re like us and live somewhere like Grand Rapids, Michigan as opposed to the Lunar Highlands of the Moon, is this really a serious question?

It is a serious question — albeit a very entertaining one as well. But how could you continue going through life without knowing the answer to questions like these?

Home and automobile insurance is a routine (let’s be honest, boring) part of life for most people, but you can always find something unexpected and entertaining if you look hard enough.

Jamie Krier of 616 Homes sat down with one of our good friends, Adam Gorbutt of Kenowa Insurance, to ask him a few off-the-wall questions about hypothetical insurance scenarios.

We were hoping we would get some entertaining answers. And we did…

Summarized below is our discussion with Adam about some “unusual” occurrences that your insurance policies very possibly might cover.

We’ve affectionately named the list “5 Things You Didn’t Know Your Insurance Covered, Including Meteorites and John Mclane”.

And while some of the scenarios (okay most) may be unlikely, it doesn’t hurt to know what you’re covered for, and it’s always fun to ask an insurance guy difficult questions he’s not used to.

1. Airplanes, Blimps, and Space Shuttles

It’s not particularly likely that an airplane or aircraft should need to make an emergency landing on your roof (fingers-crossed & knock-on-wood) .

But who knows?

I mean what if your neighbor was John Mclane from Die Hard?

And what if the plot of Die Hard 6 calls for Mclane to use your house as an emergency landing pad for the hijacked 747 he just parachuted on and re-took control of.

Photo credit: Alex Jilitsky / Foter.com / CC BY-NC-SA

Side note: Did you know they’re actually making a Die Hard 6?

Seriously. I had no idea. I jokingly referenced Die Hard 6 to Adam, and I didn’t believe him when told me it’s already filming. But check it out for yourself at ScreenRant.com.

Unfortunately, it looks like John Mclane isn’t going to have much of a role in the movie. That being said, is it even worth watching?

Okay, sorry for the Die Hard tangent — We did eventually get back to insurance.

Back to the questions…

1. Airplanes, Blimps, and Space Shuttles (continued)

747’s flown by John Mclane? What about blimps, helicopters and space shuttles?

All very unlikely, of course, but let’s consider them all just for the sake of action movie hypotheticals.

In the case of an accidental airplane, blimp, or spacecraft disaster, you WOULD likely be covered for all damage.

As a bonus, you would also likely be eligible for reimbursements related to housing (i.e. hotels) and food costs while searching for your new abode.

2. Asteroids, Comets, Meteors, and Meteorites:

So we just learned that we’re most likely covered for man-made things falling out of the sky, but what about the extra-terrestrial?

Oddly enough, would you believe that most insurance policies cover home damage in the event of galactic rock crashing into your house?

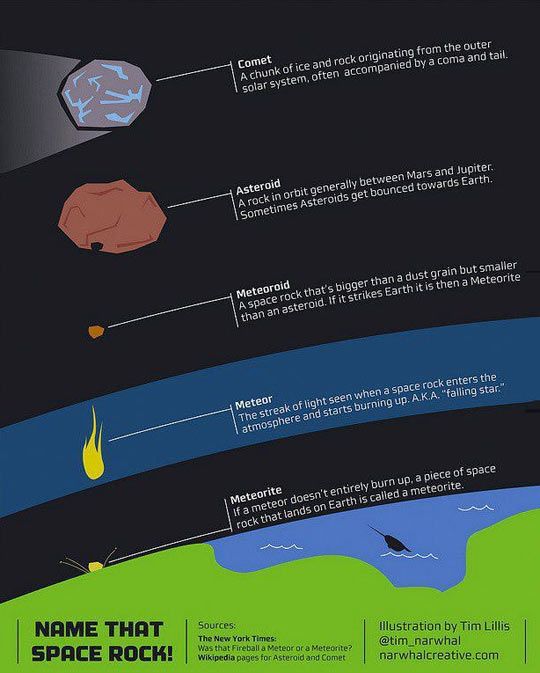

But before we go any further, first let’s get our terminology straight.

Are we talking about Comets, Asteroids, Meteors, Meteoroids, or Meteorites?

What’s the difference?

‘Name That Space Rock’ — describes the difference between all those flying rocks from space. Credit and copyright: Tim Lillis.

Okay, so if a comet or asteroid hitting Earth is part of the conversation, we’re all in big trouble.

So let’s assume we’re talking about a meteorite…

Most policies WILL cover you and give you the MAX limit on your dwelling coverage — calculated as the amount of money it would cost to rebuild your house from the ground up.

Again, as an added bonus (although would there really be any bonus if a meteorite hit your house?), if your home was rendered uninhabitable by the interstellar rock crashing through the center of your house, you could be covered for living expenses such as lodging and restaurant bills.

Nice to know we’re covered. But we were curious how rare this type of event really is.

So we looked it up.

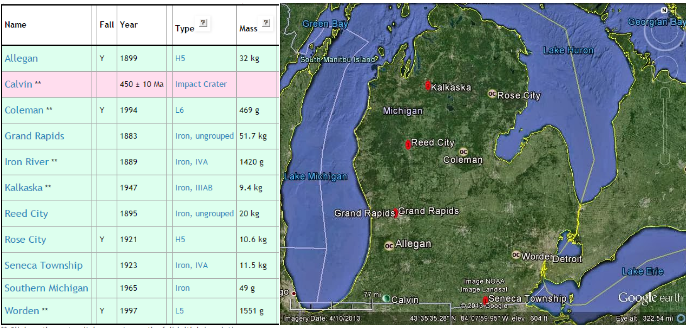

Surprisingly enough, while a meteorite hitting Earth is a rare occurrence, it wasn’t quite as rare as I thought. Meteorite strikes have been documented as many as 10 times in Michigan, twice in Grand Rapids.

Source (chart): Meteoritical Bulletin Source (map):LunarMeteoriteHunter / Meteoritical Bulletin / Google Earth

3. Riots, Explosions, and War

“April 26th, 1992, there was a riot on the streets tell me where were you?” — A lyric from one of my favorite Sublime songs, written about the very sad and historic LA Riots of 1992. More info here (LA Riots – Wikipdedia) for those of you that don’t remember, or you millennials who weren’t even born yet.

More important to our conversation, what kind of insurance protection (if any) did homeowners in LA have during the riots on that fateful day?

More than likely, standard home and auto policies probably would’ve had them covered.

And if your house is located in a slightly, shall we say unstable part of town, take comfort knowing that you too likely have coverage for any potential damage caused by riots or civil unrest.

Scary to think about, but bricks through windows, explosions, and who knows what else, can certainly be expensive. It’s good to know you’d be protected.

However, it’s interesting to note that in the case of actual war, it is unlikely your policy would provide any coverage. Unfortunately, war falls into an insurance gray area, and your bombed-out house probably would NOT be covered.

4. Flooding and Earthquakes

This is one that baffles many people. Homeowners are reminded time and again that they need a separate rider on their home insurance policy for floods and earthquakes.

Why would one of the more common scenarios for home damage in Michigan (flooding) not be covered by our normal homeowner’s policy? Unfortunately, that’s just how home insurance policies are built.

But did you know that your automobile might be covered?

Depending on whether or not your policy includes comprehensive coverage, you could be completely reimbursed if a flood washes your car away, or fills the engine block with corrosive water.

Comprehensive insurance coverage is not required by any state law, however, it may be a good idea to add it on for cases of fire, vandalism or theft, or colliding with an animal.

And if you live in an area prone to flooding, it might be worth considering comprehensive insurance coverage even more so.

Same is true if you live in an earthquake prone area, but fortunately we don’t have to worry too much about that in Grand Rapids, Michigan.

Although, let’s not forget the 2015 Earthquake on May 2nd in Grand Rapids (that almost nobody felt).

The May 2nd, 2015 Earthquake in Grand Rapids, Michigan was less than memorable. In fact, most people reported feeling nothing.

5. Missiles

Another fascinating irregularity in the insurance world is that of missile coverage. Yes, you read that right, MISSILE coverage.

It turns out, you WOULD more than likely be covered for missile strikes, as these technically fall under explosions.

The curious question here is, if your car is hit by a missile, what makes the insurance carrier think this isn’t an act of war (because as we mentioned earlier, almost nothing is covered in the case of war)? I mean it’s not very likely that the neighborhood kids accidentally lost control of their SCUD and sent it speeding into your car.

So, we’re covered on missile strikes, assuming that the strike is not a hostile act of war.

I guess you can take comfort in the fact that if you happen to be the one in ten-trillion hit by an accidental non-hostile missile, your policy has you covered!

Summary

When you sat down with your agent to talk about insurance policies and discuss different coverage scenarios, it’s not likely you talked about meteorites, missiles, or John Mclane.

But now, thanks to 616 Homes and Adam Gorbutt, you’re informed.

You’re welcome.

But please keep in mind, we went out on a limb to talk about these hypothetical policies under hypothetical scenarios, so make sure you talk to a professional about anything serious.

Remember what’s at stake when it comes to home insurance. Lots of money! We mentioned in a previous 616 Blog post that almost 91% of all mortgaged properties in the US have positive equity. That means that if you own a home, you are likely sitting on a very valuable asset. You should make sure you know in what scenarios (likely and unlikely) you have coverage.

Most importantly, make sure you have someone you can trust to talk to about insurance.

Adam is a great resource, so feel free to give him a call at (616) 828-5660 or email him at [email protected]

Just try not to waste too much of his time talking about asteroids and space shuttles.

On second thought, go ahead, it keeps him on his toes.

The above article “Got Meteor Insurance on Your Grand Rapids Home?” was written and provided by 616 Homes. If you’re thinking of selling or buying a house, we’d love to share our knowledge and expertise.

We offer real estate services in the Grand Rapids Metro Area of West Michigan. Our local knowledge and services are particularly strong in Alger Heights, Rockford, Forest Hills School District, Northview School District, Watermark Country Club, Thousand Oaks Golf Club, Downtown Grand Rapids, and Byron Center. But we’re happy to serve all areas!